Registeration companies in Turkey

Types of registeration companies in Turkey are slightly different from Iran. In Turkey there are a number of companies that are not subject to the law of commerce of the country and lack the legal personality that these types of companies are not essentially the subject of this article. But the types of companies that are subject to Turkish business law are more or less like those in Iran.

It seems that the relative company as a kind of company is special for Iran because in Turkey, like in the European countries, this kind of company does not exist. Since 90% of the companies that are established in Turkey are companies with limited liability, so here are just a brief overview of the current types of companies.

▪️iteks Types of registration in Turkey:

1. Registration of companies in Turkey in free trade zones:

Registration of companies in Turkey in free trade areas includes industrial companies in which you can buy land at suitable prices and get very good state property for the construction of niches, and get special equipment for the employee and worker, especially “For the insurance category and get tax exemptions. However, it should be noted that this registration procedure in Turkey is for export and production only, you must produce a product and you will receive a state loan for exporting to Turkey.

2. Registration of companies in Turkey – European regions:

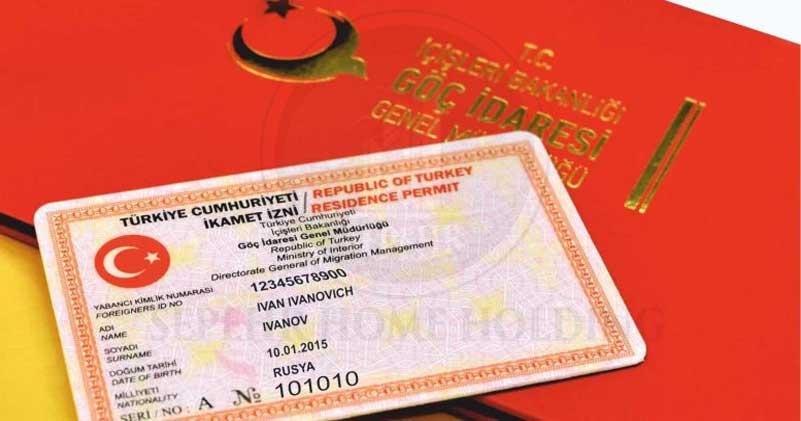

In this registration (the registration of a company in Turkey), you register a trading company authorized to do any legal activity in Turkey. Opening a bank account is one of the other options for registering a company in Turkey. Do not worry about your stay because you can take advantage of the benefits of taking a residence by registering and employing two employees and insuring them. Do not ignore the correct and timely payment of taxes.

Limited liability company:

The limited liability company in Turkey has a minimum of two and a maximum of 50 partners (although under the new law, the company can be registered with even a shareholder) and the liability of each shareholder in the company’s limited liability company’s investment In the simplest way, if the company becomes bankrupt and can not meet the creditors, only the shareholders’ equity will be eliminated and the creditors can not claim the remainder of their claims from the partners of the company. Minimum capital to establish a liability company Limited is 50,000 Turkish liras and any modification and transfer of the share of partners must be In the official office.

The remuneration received from the customer for this type of stay is 1,700 dollars, the total cost to us is 900 dollars.

◄ Required to register a limited liability company in Turkey:

– Principal passport of each partner with more credibility (from 6 months)

– Two pieces of photo (colored – clear background)

– Several names for the company

– Field of activity of the company

– Determine the percentage of shares of each of the partners in the company

– appointing the director of the company (one of the partners)

– Determine the office address of the company in Turkey

– Granting attorney to a designated person from the Strategic Office for Company Registration

– Minimum capital of 50,000 Turkish lira

– An accountant fee that should be paid to them every 1,000 lire each month.

Joint stock company (with unlimited liability):

Establishing this kind of company requires at least 5 individuals or legal entities. The partners are liable for their share of debt and debt.

Capital companies must be divided into equal parts and each component is to be divided. Partners do not have to have only one share, but each partner can buy at any rate.

According to the Turkish Trade Act, meetings of the General Assembly should be held with representatives of the Turkish Ministry of Commerce.

Joint stock companies are divided into two types:

Private Joint-Stock Company: Companies with 250 shareholders.

Public Joint Stock Company: Companies with more than 250 shareholders.

Required Documents to Register an Unlimited Company in Turkey:

– Principal passport of each partner with more credibility (from 6 months)

– Two pieces of photo (colored – clear background)

– Several names for the company

– Field of activity of the company

– Determine the percentage of shares of each of the partners in the company

– appointing the director of the company (one of the partners)

– Determine the office address of the company in Turkey

– Granting attorney to a designated person from the Strategic Office for Company Registration

– At least 300,000 Turkish liters

– An accountant fee that should be paid to them every 1,000 lire each month.

The wage received from the customer for this type of stay is $ 2,500, and the total cost us to do is $ 1,200.

4- General Partnership company:

A company that is under a special name is formed between two or more persons with a guaranteed liability, and if the company’s assets are not sufficient for the approval of all companies’ debts, each of the partners is responsible for paying all debts.

5. Partnership company:

In this type of company, one or more of the partners is a guarantor of all debts and shares with the company, and other partners are against the company’s debts only in relation to their capital at the company. Legal entities cannot be partners of the guarantor.

The most preferred and most types of companies that are preferred in Turkey are respectively Limited Liability Company and a special joint stock company.

6. Financial institutions (Exchange):

The establishment of such financial institutions is possible in the form of a joint stock company. But the establishment of these types of institutions requires the licensing of the relevant organizations that these organizations do not currently issue.

However, the establishment of such financial institutions is possible in a special and completely legal way, which will be required if the applicant’s friends come to their co-operation.